Condo Insurance in and around Minneapolis

Looking for outstanding condo unitowners insurance in Minneapolis?

Condo insurance that helps you check all the boxes

Your Belongings Need Protection—and So Does Your Condominium.

When it's time to wind down, the home that comes to mind for you and your loved onesis your condo.

Looking for outstanding condo unitowners insurance in Minneapolis?

Condo insurance that helps you check all the boxes

Put Those Worries To Rest

We understand. That's why State Farm offers outstanding Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Selina Martire is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that provides what you want.

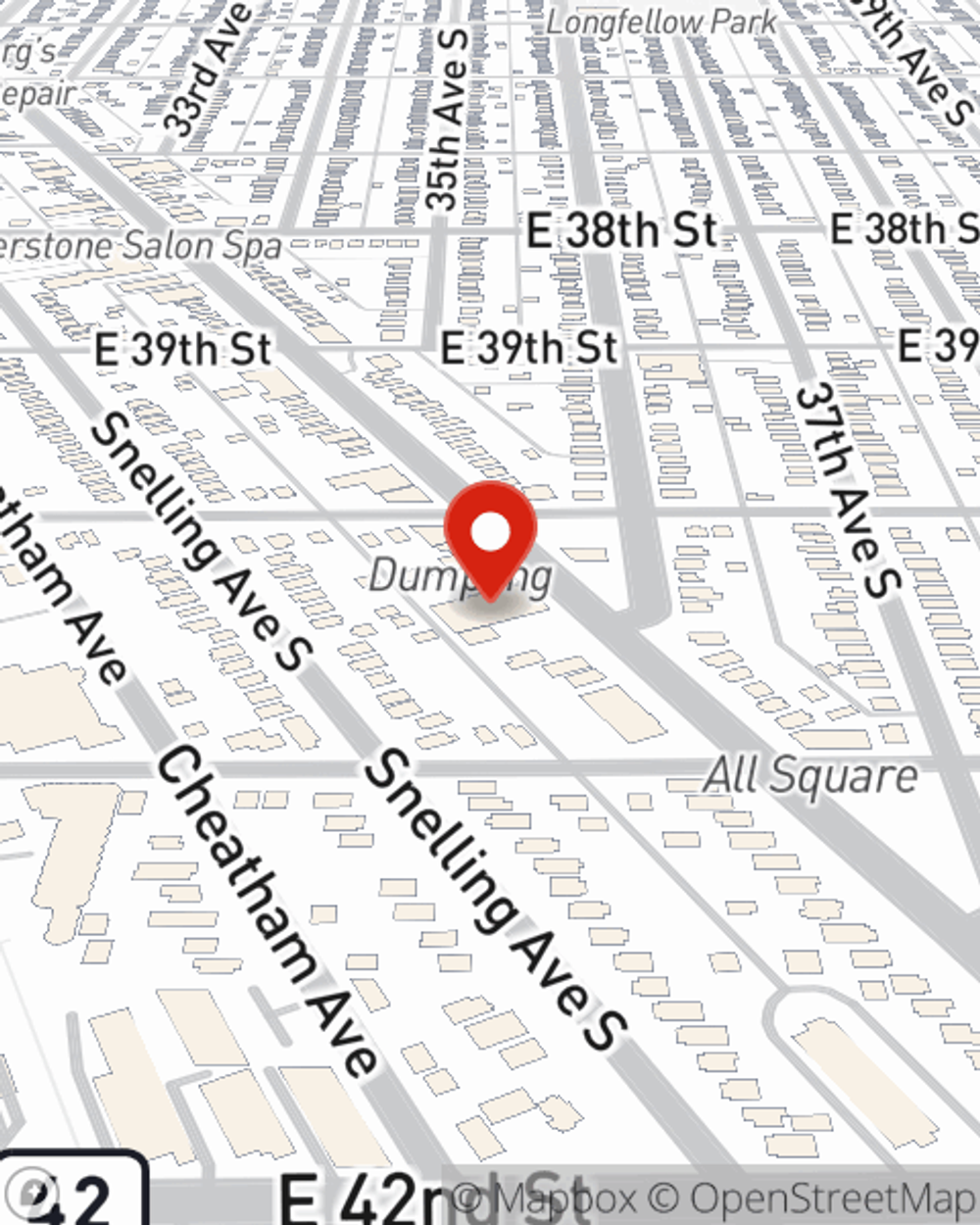

When your Minneapolis, MN, condo is insured by State Farm, even if the worst comes to pass, State Farm can help protect your one of your most valuable assets! Call or go online now and find out how State Farm agent Selina Martire can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Selina at (651) 776-8328 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Selina Martire

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.