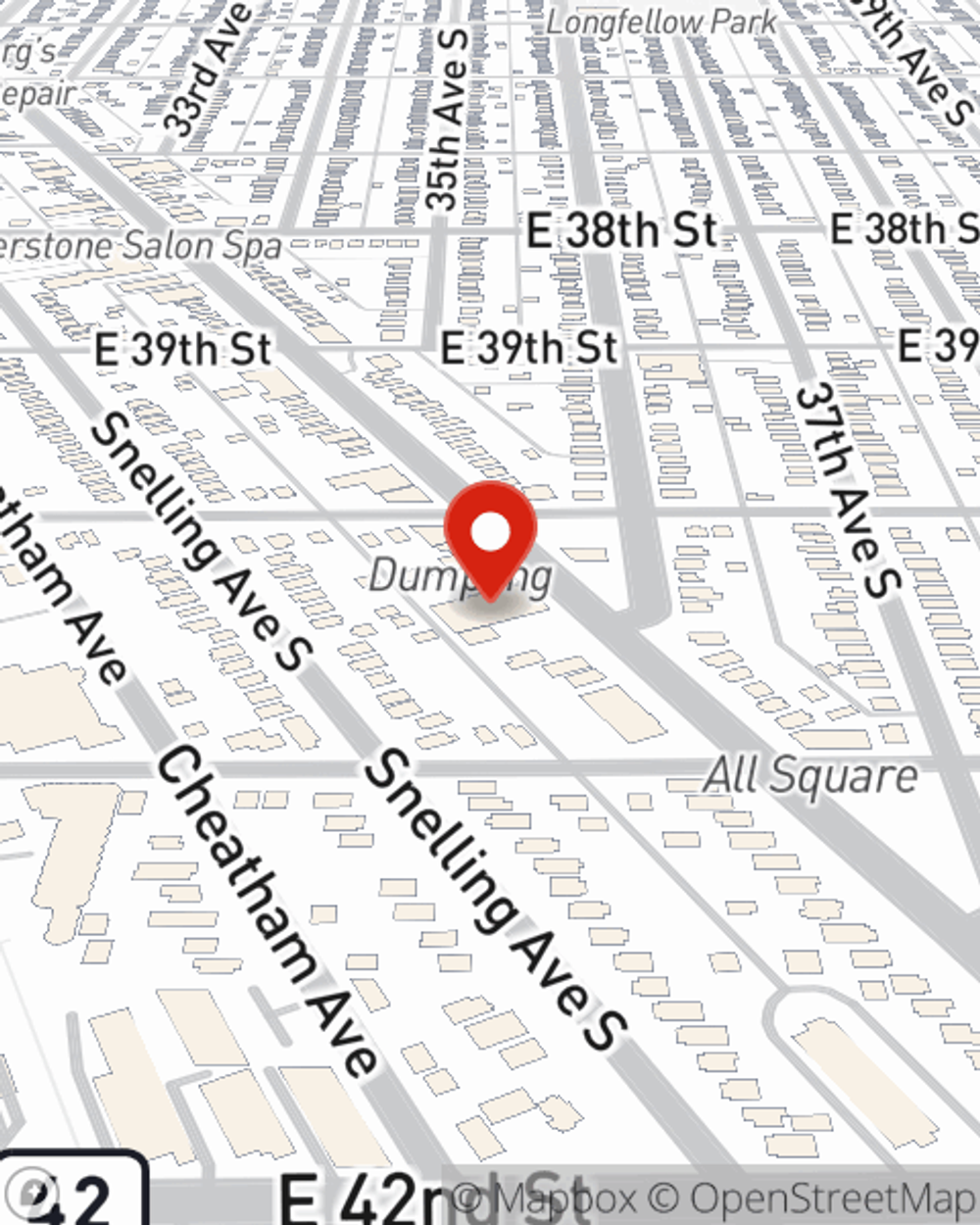

Business Insurance in and around Minneapolis

Get your Minneapolis business covered, right here!

Helping insure small businesses since 1935

Business Insurance At A Great Value!

As a small business owner, you understand that sometimes the unanticipated does occur. Unfortunately, sometimes problems like a customer hurting themselves can happen on your business's property.

Get your Minneapolis business covered, right here!

Helping insure small businesses since 1935

Protect Your Business With State Farm

With options like extra liability, errors and omissions liability, worker's compensation for your employees, and more, having quality insurance can help you and your small business be prepared. State Farm agent Selina Martire is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does happen.

Take the next step of preparation and reach out to State Farm agent Selina Martire's team. They're happy to help you investigate the options that may be right for you and your small business!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Selina Martire

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.